MyMoneyMantra (MMM) stands out as India’s premier Finserve marketplace, offering customers a comprehensive platform to compare products from over 100 Financial Institutions. In the past five years alone, MMM has facilitated the origination of financial services products worth over $5 billion through its platform. Currently, it caters to approximately seven million customers spread across 60 cities, boasting partnerships with over 100 banking institutions and employing a workforce of 3000 strong.

To further propel its digital transformation, MMM secured a notable funding of INR 104 crore (USD 15 million) from IFSD BV based in the Netherlands and Vaalon Capital. Notably, MMM ranks among India’s largest credit originators, with FY 19 witnessing the origination of $870 million in credit. Since its inception, MMM has maintained profitability and consistently achieves a commendable 25% to 30% Compound Annual Growth Rate (CAGR).

In contrast to many of its fintech counterparts, MMM has not only thrived but also achieved profitability within a decade of existence. By projecting a revenue of approximately $24 million for the full year of 2020, marking a 22% growth from 2019, MMM has demonstrated significant prowess. Remarkably, MMM achieved this revenue milestone without burning cash, exiting March 2020 with a topline of $24 million, more than doubling its previous figure.

MMM is taking on formidable competitors like BankBazaar and Paisabazaar, leveraging its robust distribution network and expanding digital footprint to accelerate its growth trajectory. For instance, while BankBazaar’s topline stands at $11 million after a substantial $100 million cash burn over 12 years, MMM has managed to achieve twice the topline without compromising its financial health.

Moreover, MMM’s FY19 credit origination was an impressive 58 times its Total Amount of Capital Raised (TACR), with revenue surpassing 144% of TACR. This demonstrates MMM’s ability to achieve substantial scale without relying on multiple funding rounds, thereby solidifying its position in the fintech landscape.

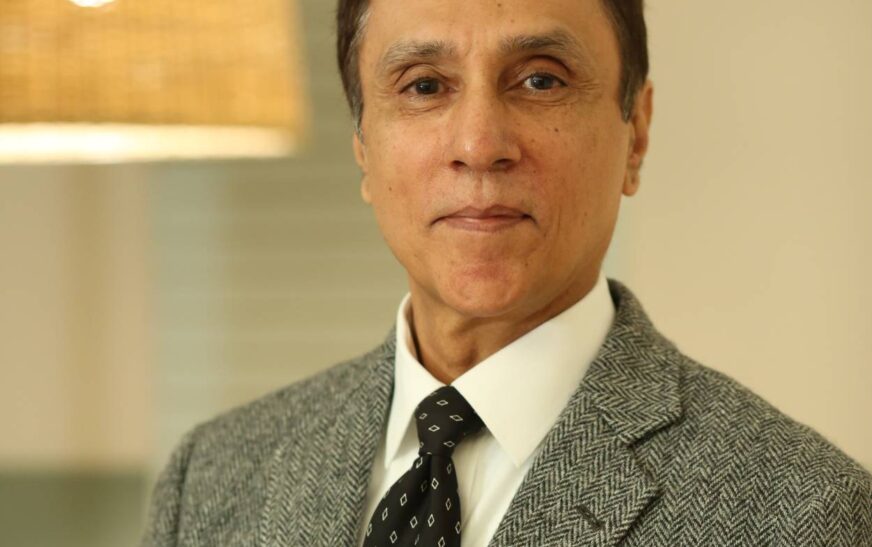

In a distinguished conversation with The Interview World, Raj Khosla, the Founder and Managing Director of MyMoneyMantra, illuminates the significant milestones attained by his company. He discusses their unique offerings, emphasizing their utilization of technology to elevate customer experience and fortify transparency in operations. Below are the pivotal highlights from his interview.

Q: Could you provide an overview of MyMoneyMantra’s journey so far, highlighting key milestones and achievements?

A: At MyMoneyMantra, we’ve encountered numerous instances where we needed to navigate carefully by reducing costs and optimizing economies of scale. Additionally, we’ve seen significant progress in capturing a larger market share by offering tailored financial products to consumers.

When distributing financial products, it’s crucial for a financial intermediary to adapt to the changing business landscape, evolving consumer demands, and the right distribution strategy.

Founded in 1989, MyMoneyMantra has successfully navigated through various policy changes while maintaining its commitment to providing comprehensive support to customers. In 2019, Vaalon Capital, a Europe-based private equity firm, acquired a minority stake in MyMoneyMantra for Rs 104 crore. Remaining profitable since its inception, MyMoneyMantra operates on a sustainable model that benefits lenders, consumers, and the company alike.

Q: How does MyMoneyMantra differentiate itself from other personal finance marketplaces in the industry?

A: MyMoneyMantra distinguishes itself through its innovative ‘phy-gital model,’ seamlessly integrating physical and digital channels. This unique approach harnesses our existing databases while strategically redirecting distribution through digital platforms, unlike startups heavily dependent on funding and facing high expenditure to generate leads.

Our keen understanding of financial product distribution dynamics empowers us to continually optimize strategies. We view distribution enhancement as an iterative process, committed to refining our methods with each passing day. By blending traditional and digital avenues, we ensure efficient and effective access to financial products, solidifying our position as a leader in the industry.

Q: With the rise of digital banking and fintech, how has MyMoneyMantra adapted its business model to stay relevant in the market?

A: Over the past thirty years, the banking sector has undergone a remarkable evolution, witnessing substantial advancements in its systems and processes. At MyMoneyMantra, we have recognized the need to adapt to this changing landscape by establishing dedicated digital teams. These teams are instrumental in devising innovative solutions tailored to address the challenges of the modern age. Our commitment to optimizing processes is integral to fostering business growth and staying competitive in the dynamic market environment.

By harnessing the power of Big Data and AI, we can effectively extract valuable insights necessary to sustain our operations. Furthermore, we remain vigilant to detect and respond to shifts in consumer preferences, ensuring that our distribution systems are agile enough to serve both unbanked segments and individuals new to credit, thereby expanding financial inclusion.

Q: Transparency and trust are crucial in the financial services industry. How does MyMoneyMantra maintain transparency in its dealings with customers and financial institutions?

A: Effective management of transparency relies on conducting operations openly. We ensure that our services remain completely free of charge, focusing solely on meeting your needs. At MyMoneyMantra, we pride ourselves on providing a customer experience akin to that of a luxury hotel, complete with a dedicated concierge. Understanding each customer’s unique requirements, we tailor our services by presenting relevant offers tailored to individual profiles and needs, empowering them to make informed decisions.

Furthermore, we strive to offer a seamless experience by providing comprehensive support from the initial onboarding process to the eventual disbursement, whether it be for personal loans, home loans, loans against property, or the issuance of a credit card.

Q: How does MyMoneyMantra leverage technology to enhance the customer experience and streamline processes?

A: At MyMoneyMantra, we are dedicated to optimizing the customer experience through cutting-edge technology. Our commitment extends to addressing underrepresented demographics, providing customized solutions such as short-term personal loans with adjustable repayment plans and competitive interest rates. For example, our array of credit cards caters to diverse needs, offering a spectrum of fee structures, benefits, and reward point systems. This ensures that individuals seeking to maximize benefits from shopping and travel can select a card perfectly suited to their preferences and lifestyle. We aim to empower customers with tailored financial solutions that enhance their financial well-being and satisfaction.